Managing your business finances shouldn’t be confusing especially when choosing the right software.

If you’re researching Xero Pricing 2025, you’re probably wondering: “Is it affordable for my business, and what do I actually get for the price?” 💰

Start your 30-day free trial today

Xero is known for simple accounting, clean design, and strong payroll tools but the pricing differences between plans can feel unclear without a proper breakdown. ➡️

So in this guide, we’ll simplify everything in plain English, give real-world examples, highlight hidden costs, and help you choose the right plan confidently.

📌 What is Xero? & It’s Features

Xero is a cloud-based accounting platform built for small and medium-sized businesses. It helps you manage invoicing, bookkeeping, payroll, expenses, cash flow, and reporting all in one place.

One of the biggest advantages is how beginner-friendly it is. Even if you’re not a finance expert, Xero makes managing money feel easy.

It also syncs with your bank in real time and connects with 1,000+ apps for smoother business workflows.

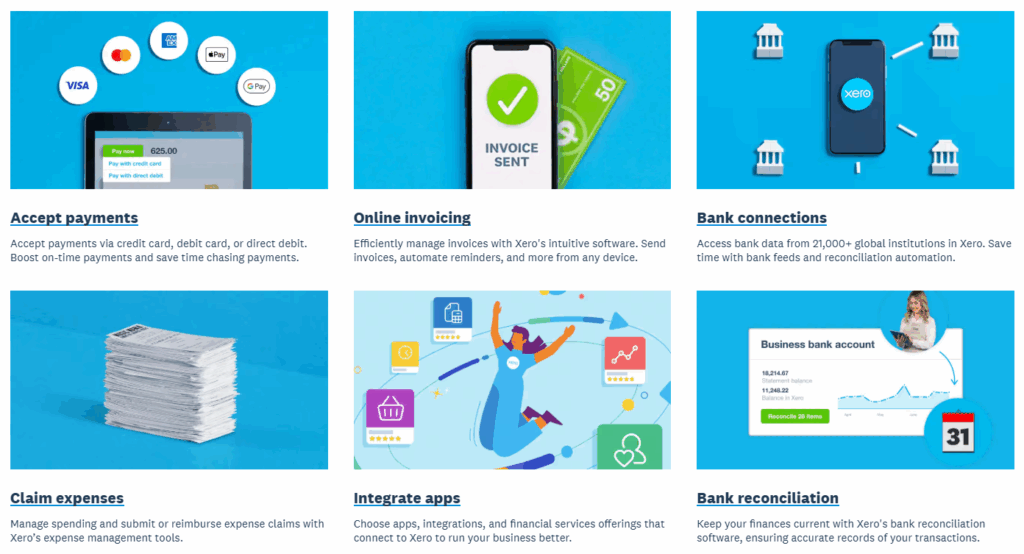

Key Features of Xero:

- Accounting Tools: Xero allows you to create invoices, track expenses, and reconcile bank transactions in real-time.

- Payroll Integration: Xero seamlessly integrates payroll management, enabling businesses to handle employee payments, tax filings, and compliance.

- Cloud-Based Access: As a cloud software, Xero can be accessed from any device, anytime, ensuring your business finances are always up to date and accessible.

- Reporting: Xero provides various financial reports, including profit and loss statements, balance sheets, and tax reports.

- Business Collaboration: Xero enables accountants, bookkeepers, and other team members to collaborate seamlessly, ensuring accurate and timely financial management.

Check our full Xero Review 2026 to understand how the software performs in day-to-day use.

📌 Xero Payroll Pricing Breakdown

Xero offers three main pricing plans, each designed to cater to different business needs.

The following details will help you understand the features available with each plan, as well as the current pricing for each.

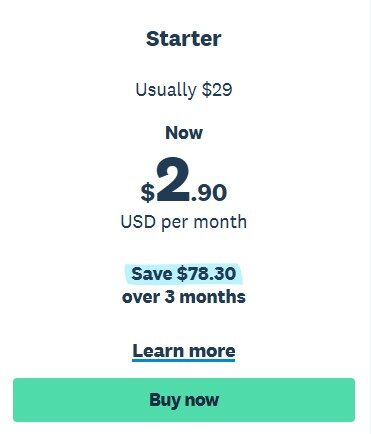

1. Starter Plan – $2.90/month

(Originally $29/month — introductory offer)

🎯 Best for: Freelancers, solopreneurs, micro-businesses

🔹 Features You Get

✔ Send quotes and up to 20 invoices

✔ Enter up to 5 bills

✔ Reconcile bank transactions

✔ Receipt scanning through Hubdoc

✔ Short-term cash flow dashboard

📝 Who should choose it?

Good for very small operations that only send a few invoices monthly.

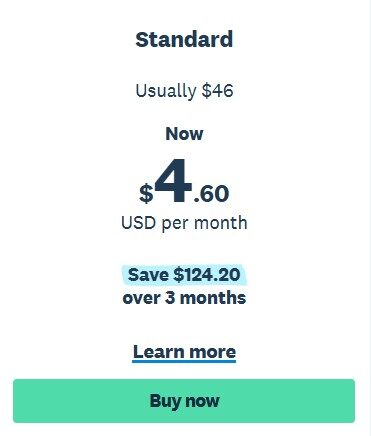

2. Standard Plan – $4.60/month

(Originally $46/month — introductory offer)

🎯 Best for: Growing businesses needing unlimited usage

🔹 Features You Get

✔ Send unlimited invoices

✔ Enter unlimited bills

✔ Reconcile bank transactions

✔ Multi-currency transactions

✔ Bulk transaction reconciliation

✔ Receipt capture (Hubdoc)

✔ Cash flow tools

📝 Who should choose it?

Start here if you have recurring bills, more clients, or growing monthly transactions.

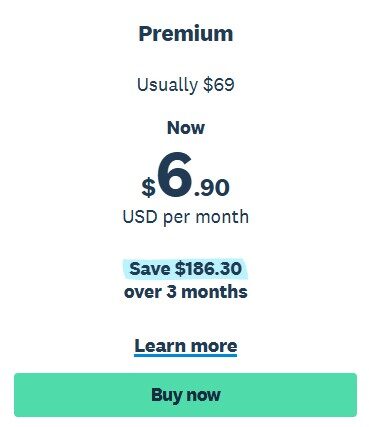

3. Premium Plan – $6.90/month

(Originally $69/month — introductory offer)

🎯 Best for: International businesses or companies handling foreign currency

🔹 Features You Get

✔ Everything in Standard

✔ Advanced multi-currency

✔ Claim and approve expenses

✔ Project tracking

✔ Analytics Plus

✔ Best automation features

📝 Who should choose it?

Businesses working with overseas clients, eCommerce sellers, agencies, and global teams.

To activate these intro prices, you can use the Xero Free Trial 30 days + 90% Off for 6 Months offer.

Key Features of Each Plan

1. Essential Plan (Payroll Basics)

This plan covers the fundamentals of payroll processing:

- Automated tax updates

- Employee payslips

- Submission of payroll data to government authorities (like HMRC in the UK)

- Simple leave management

Great for businesses with 1–10 employees.

2. Premium Plan (Advanced Payroll)

Includes everything in Essential plus:

- Multi-user access

- More advanced payroll reporting

- Customizable pay calendars

- Multi-currency payments

- Larger teams support

Ideal for businesses managing complex payroll requirements.

📌 How Much Does Xero Payroll Cost in 2025?

Xero Payroll pricing depends mainly on the number of employees and your country. While Xero does not include payroll inside accounting plans, you can add payroll separately.

💰 Common Pricing Model (Typical Range):

- Base Fee: Around $40/month

- Per Employee Fee: $6–$7 per employee

🧠 Example

A business with 5 employees may pay:

- Base: $40

- Per employee: 5 × $6 = $30

- Total: ~$70/month

This model keeps payroll affordable for small teams while scalable for larger companies.

📌 For accuracy, users should always check the official Xero pricing page.

External resource:

✔ IRS Payroll Tax Guide — https://www.irs.gov/businesses/small-businesses-self-employed/employment-taxes

✔ Wikipedia: Cloud Accounting — https://en.wikipedia.org/wiki/Cloud_accounting

📦 Xero Add-Ons Pricing (2026)

Xero’s main plans cover basic accounting, but many businesses use add-ons to access advanced features. These add-ons can increase your total monthly cost depending on your team size and needs.

⭐ 1. Xero Payroll Add-On

- Base Fee: ~$40/month

- Per Employee: $6–$7

- Adds: Pay runs, tax filing, employee portal, timesheets

⭐ 2. Xero Projects

- Price: ~$7/user/month

- Adds: Time tracking, job costing, project profitability

⭐ 3. Xero Expenses

- Price: ~$4/user/month

- Adds: Expense claims, receipt capture, mileage tracking

⭐ 4. Analytics Plus

- Price: ~$5–$7/month

- Adds: Advanced forecasting and long-term cash flow insights

⭐ 5. Hubdoc

- Price: Included in all Xero plans

- Adds: Receipt scanning and document automation

- 📘 Quick Add-On Summary

- Payroll: ~$40 + $6–$7/employee

- Projects: ~$7/user

- Expenses: ~$4/user

- Analytics Plus: ~$5–$7

- Hubdoc: Included

📌 Xero Payroll for Small vs Large Businesses

🟦 Small Business Benefits

Small companies benefit from:

- Lower per-employee costs

- Simple compliance

- Automated tax calculations

- Quick setup

- Mobile payroll approvals

Perfect for cafes, salons, freelancers hiring staff, home-based businesses, and small agencies.

🟩 Large Business Benefits

Medium or large companies get value from:

- Multi-user access

- Project costing + payroll syncing

- Custom reports

- Multiple pay calendars

- Advanced expense tracking

Great for companies with 20+ employees or multi-department setups.

Explore Xero vs Sage to compare which software suits larger operations better.

📌 Additional Costs and Hidden Fees

While Xero is transparent, a few additional charges may apply:

🔸 1. Extra employees beyond plan limits

As your team grows, charges increase.

🔸 2. Add-ons

Examples:

- Pension auto-enrollment

- Advanced HR tools

- Additional integrations

🔸 3. Third-party app fees

Inventory apps, CRM tools, advanced reporting tools.

🔸 4. Migration or setup help (optional)

Most businesses won’t pay hidden fees unless they use add-ons heavily

📌 Xero’s Unlimited Users Advantage (Huge Selling Point)

One of the biggest cost-saving benefits of Xero is that every plan includes unlimited users at no extra cost.

This makes Xero a far better long-term choice for growing businesses compared to tools that charge per user.

Businesses with accountants, bookkeepers, multiple managers, or remote teams save a significant amount of money simply because Xero does not penalize you for adding more people.

To understand how big this advantage is, here’s a clear comparison:

📘 Xero Unlimited Users Advantage: Comparison Table (2026)

| Software | Best For | Starting Price | Key Strength | Weakness |

|---|---|---|---|---|

| QuickBooks Online | Advanced accounting & detailed reporting | $30/mo | Strong reporting, deep automation | More expensive with add‑ons |

| FreshBooks | Freelancers & service‑based work | $17/mo | Easiest invoicing & client billing | Weak inventory & multi‑currency |

| Wave Accounting | Very small businesses, beginners | Free | Free invoicing & bookkeeping | Limited automation, no inventory |

| Sage Accounting | Compliance‑heavy traditional businesses | $10/mo | Strong ledger, reliable compliance | Old‑school interface, less beginner‑friendly |

| Zoho Books | Affordable CRM‑friendly solution | $15/mo | Best value + integrates with Zoho CRM | Limited third‑party integrations |

| Xero (Reference) | Growing SMEs, eCommerce, global business | $15/mo | Multi‑currency, automation, 800+ apps | No phone support, starter limits |

⭐ Why Xero Wins in the User Limit Comparison

| Benefit | Xero | QuickBooks | FreshBooks | Zoho Books |

|---|---|---|---|---|

| Unlimited Users | ✅ Yes | ❌ No | ❌ No | ❌ No |

| Cost for Extra Users | ₹0 | High | High | Medium |

| Ideal for Teams | Large, growing, remote teams | Limited role‑based teams | Solo/freelance | Small teams |

| Scalability | ⭐ Excellent | ⚠ Requires plan upgrades | ❌ Poor | ✔ Good |

📌 Why Choose Xero Payroll? (Benefits)

- ⭐ Ease of Use:

Xero Payroll is known for its user-friendly interface, making it accessible even for non-technical users. - ⭐ Works Seamlessly With Xero Accounting:

Since it integrates directly with Xero’s accounting software, businesses can streamline their finances and payroll into one system. - ⭐ Cloud-Based Flexibility:

Xero Payroll is accessible from anywhere, allowing for real-time updates and remote access to your payroll data. - ⭐ Scalable for Every Business:

It caters to a variety of business sizes and industries, from startups to more established companies.

📌 Xero Payroll Features for Remote Teams

Xero Payroll is a powerful tool for managing payroll, especially for remote teams.

With Xero’s cloud-based platform, you can easily run payroll from anywhere, ensuring your employees are paid on time, no matter their location.

The software supports multi-currency and multi-country payroll, making it ideal for global teams.

With automatic tax calculations and compliance updates, Xero ensures that your remote team stays compliant with local tax laws.

Additionally, Xero offers detailed reports and easy employee self-service options, allowing employees to access payslips, tax documents, and leave balances anytime.

📌 Internal suggestion:

Explore our Xero vs QuickBooks comparison to see which software fits your business better.

📌 Mobile Access for Xero Payroll

- Employee Access:

Employees can access their payslips, tax forms, and leave balances directly from their mobile device. - 📱 Mobile App for Employers:

Owners can:- Approve payslips

- View payroll reports

- Check employee leave

- Process payroll on the go

📌 Conclusion: Is Xero Pricing 2025 Worth It?

Xero Payroll offers real value for small and medium-sized businesses.

Its cloud-based tools, easy interface, and automation help reduce manual work and compliance stress.

If you’re a startup or small team, start with the Essential plan it’s affordable and covers everything you need.

As your business grows, upgrading to Premium unlocks more advanced tools.

Overall, Xero balances price, performance, automation, and ease of use, making it one of the best payroll solutions for growing businesses in 2025.

▶️ Watch: Xero Pricing Plans Review – What To Know Before Buying

📌 FAQs

❓ Can Xero Payroll Handle Multiple Companies?

Yes. You can manage payroll for multiple businesses, but each company may require its own subscription.

❓ Does Xero include payroll automatically?

No, payroll is a separate add-on costing extra per employee.

❓ Is Xero cheaper than QuickBooks?

In most cases, yes especially because Xero allows unlimited users at no extra cost.

❓ Is Xero good for small businesses?

Absolutely. Its simplicity, automation, and pricing make it ideal for small teams.

❓ What’s the biggest advantage of Xero Payroll?

Time savings. Automated calculations, compliance updates, and simple workflows cut hours of manual work each month.

I’m a CRM and Xero expert with over 6 years of experience. I specialize in researching, testing, and simplifying complex systems like Xero and other CRM tools. From setting up workflows to writing easy-to-understand content, I help businesses choose the right platforms and use them better for real growth.