Choosing between Xero vs QuickBooks is one of the most important financial decisions for your business.

The software you pick will determine how fast you manage invoices, how accurate your taxes are, and how efficiently your team collaborates.

But here’s the truth 👉 Both tools are excellent, yet they suit very different types of businesses.

Start your 30-day free trial today

70% OFF QuickBooks for 3 months

If you choose the wrong one, you’ll end up paying more, wasting time, and struggling with features you don’t even need.

This ultimate 2025 comparison gives you a clear winner with proof, so you can avoid costly mistakes and pick the tool that actually fits your business.

Let’s dive in. 🚀

#1 What Are Xero & QuickBooks?

Xero and QuickBooks are cloud-based accounting platforms that help businesses manage invoicing, expenses, banking, payroll, reporting, and compliance from one dashboard.

Both aim to replace spreadsheets and manual accounting, but they approach it differently:

- Xero → Global-friendly, unlimited users, simpler UI

- QuickBooks → US-focused, deeper reporting, stronger payroll

If you’re running a modern small or medium-sized business, the difference between the two can dramatically affect your daily workflow.

👉 Want to learn the basics step-by-step? Here’s a complete guide on how to use Xero software for your business.

#2 Quick Comparison Snapshot

A text-based comparison that helps readers and boosts Google snippets.

| Feature | Xero | QuickBooks |

|---|---|---|

| Ease of Use | Easier for beginners | More complex but powerful |

| Users Allowed | Unlimited | Limited per plan |

| Multi‑Currency | All plans | Only higher plans |

| Payroll | Add‑on | Built‑in across many plans |

| Best For | Global teams, growing SMBs | US‑based businesses, heavy payroll |

| Automation | Strong | Very strong |

| Mobile App | Clean, simple | Feature‑rich but complex |

📌 In short: Xero = simplicity & scalability | QuickBooks = depth & US payroll strength

#3 Xero vs QuickBooks Feature Comparison

Both tools provide the essentials. But they differ in how much automation, customization, and flexibility they offer.

Below is the clean, expanded, easy-to-understand version:

🧾 1. Invoicing Comparison

| Invoicing Tools | Xero | QuickBooks |

|---|---|---|

| Main Features |

Unlimited invoices across all plans Clean, modern invoice templates Convert quotes → invoices instantly Multi‑currency invoice support Automatic reminders Payment links via Stripe, PayPal |

Highly customizable invoice templates ACH, card, and PayPal payments Smart invoice tracking Auto‑reconciliation Convert estimates to invoices |

| Verdict | Better for unlimited usage and simplicity | Better for customization‑heavy workflows |

💳 2. Payment Processing

| Payments & Billing | Xero | QuickBooks |

|---|---|---|

| Capabilities |

Ideal for global clients Multi‑currency support Connects with PayPal, Stripe, Wise Strong bill management system |

Accepts ACH, cards, PayPal QuickBooks GoPayment mobile POS Automatic matching with bank transactions Better for US businesses |

| Verdict | Stronger for international payments | Stronger for US‑focused billing |

🧾 3. Payroll

| Payroll Tools | Xero | QuickBooks |

|---|---|---|

| Features |

Add‑on payroll only Available only in supported regions Employee self‑service portal Automatic tax updates |

Full payroll suite Direct deposit in all US states Automatic tax filing HR tools and forms |

| Verdict | Basic payroll where available | Clear winner if payroll is important |

📊 D) Reporting & Compliance

| Reporting & Compliance | Xero | QuickBooks |

|---|---|---|

| Reporting |

Great real‑time insights Profit & Loss, Balance Sheet, Cash Flow Basic + advanced reports Good for quarterly and annual summaries |

Industry‑specific reports Custom report builder Strong US tax reporting TurboTax integration |

| Verdict | Easier to use | Deeper and more detailed |

🔌 E) Integrations

| Integrations | Xero | QuickBooks |

|---|---|---|

| Ecosystem |

1,000+ integrations Great for inventory, POS, payroll, eCommerce Works well with Shopify, Stripe, HubSpot |

650+ integrations Best with Intuit ecosystem Good with Square, PayPal, Gusto |

| Verdict | Xero is stronger for global and diverse integrations | |

📱 F) Mobile App

| Mobile App | Xero | QuickBooks |

|---|---|---|

| App Experience |

Clean and minimal Good for invoices, bills, and receipts Very beginner‑friendly |

Feature‑heavy Many tools in one app Some users may find it overwhelming |

| Verdict | Simpler and easier to use | More powerful but complex |

#4 The Right Choice for You: Xero or QuickBooks?

Choosing between Xero and QuickBooks is easier when you match each tool to the type of business it fits best. Here’s a simple breakdown to help you decide:

✔️ Xero Is Best For:

- Fast-growing small & medium businesses that require a clean, simple accounting workflow

- Teams needing unlimited users without paying extra

- Remote or distributed teams that collaborate daily

- Businesses working internationally (multi-currency included in all plans)

- Service businesses, agencies, consultants, and eCommerce sellers

- Anyone wanting affordable pricing with strong automation

Why choose Xero?

Xero is built for modern, growing companies that want simple accounting, global flexibility, and cost-efficient scaling.

✔️ QuickBooks Is Best For:

- US-based companies that rely on specific US tax rules

- Businesses with heavy payroll needs (QuickBooks Payroll is much stronger)

- Firms needing advanced reporting and deep financial analysis

- Accountant-led companies that already use Intuit tools

- Businesses that rely on TurboTax, QuickBooks Payroll, or Intuit Payments

- Contractors, construction firms, and mid-sized teams with detailed financial requirements

Why choose QuickBooks?

QuickBooks delivers unmatched US payroll + tax features and advanced analytics that suit accountant-driven operations.

👉 For beginners, here’s a simple tutorial on how to use QuickBooks Online.

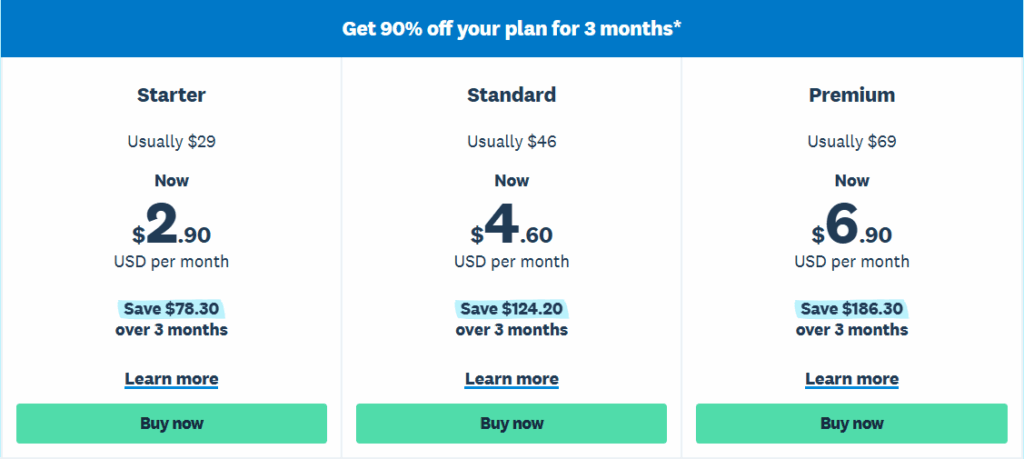

#5. Pricing Plans Comparison

Xero offers more affordable pricing for small businesses, with plans starting as low as $2.90/month, while QuickBooks is generally pricier, starting at $9.50/month for its entry-level plan.

QuickBooks Pricing Plans

- Simple Start:

- Price: $9.50/month (originally $19)

- Savings: Save $10/month for the first 3 months

- Ideal for: Freelancers and solopreneurs with basic accounting needs.

- Essentials:

- Price: $14/month (originally $28)

- Savings: Save $14/month for the first 3 months

- Ideal for: Small businesses with a few employees needing basic payroll and bill management.

- Plus:

- Price: $20/month (originally $40)

- Savings: Save $20/month for the first 3 months

- Ideal for: Growing businesses that need more detailed reporting, inventory management, and project tracking.

- Advanced:

- Price: $38/month (originally $76)

- Savings: Save $38/month for the first 3 months

- Ideal for: Larger businesses with more complex accounting needs, including custom reporting and dedicated account support.

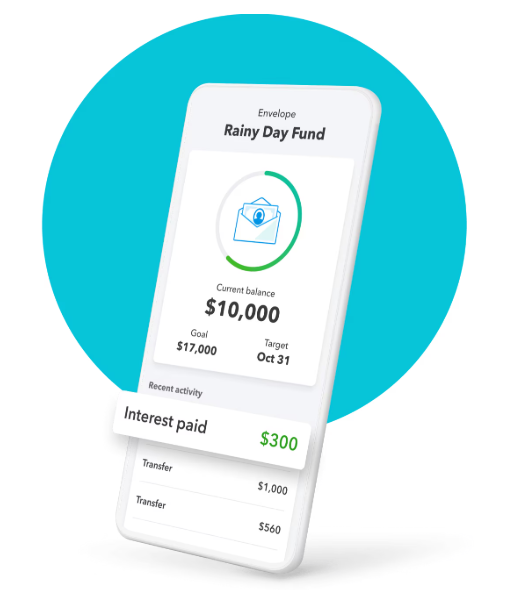

Xero Pricing Plans

- Starter:

- Price: $2.90/month (originally $29)

- Savings: Save $78.30 over the first 3 months

- Ideal for: Freelancers and sole traders with very basic accounting needs.

- Standard:

- Price: $4.60/month (originally $46)

- Savings: Save $124.20 over the first 3 months

- Ideal for: Small businesses needing additional features like invoicing, bank reconciliation, and multi-currency support.

- Premium:

- Price: $6.90/month (originally $69)

- Savings: Save $186.30 over the first 3 months

- Ideal for: Larger businesses or those with more complex accounting needs, including the ability to track multiple currencies and manage payroll.

#6. User Interface and Ease of Use

Xero is known for its clean, intuitive design, making it easy for beginners, whereas QuickBooks offers a more feature-rich interface that may take some time to master for new users.

Xero

- Xero is highly praised for its clean, simple, and easy-to-navigate interface. Its dashboard is customizable, and everything is organized in a way that makes it intuitive, even for beginners.

- Whether you’re creating invoices or reconciling transactions, everything is straightforward.

QuickBooks

- QuickBooks is slightly more complex, particularly for new users. However, once you get the hang of it, it offers a comprehensive range of features.

- Its interface is user-friendly, but the learning curve can be a bit steeper compared to Xero, especially if you’re using the desktop version.

#7. Integrations

Xero integrates with over 1,000 third-party apps, providing more flexibility for various business tools, while QuickBooks offers a strong integration ecosystem, particularly with Intuit services and key business platforms.

Xero

- Xero has over 1,000 third-party app integrations. These include popular tools like Shopify, Stripe, PayPal, and Google Sheets.

- Xero also integrates well with project management tools like Trello and Asana, allowing users to sync accounting and project data seamlessly.

QuickBooks

- QuickBooks integrates with over 650 third-party applications, including tools like Zapier, PayPal, and Square. It also offers advanced integrations with Google products and various CRMs.

- QuickBooks provides better integration with Intuit products, especially for users who also use TurboTax or QuickBooks Payroll.

#8. Accounting for Different Business Sizes

Xero is better suited for small to medium-sized businesses with its scalable pricing, while QuickBooks is more versatile, serving both small businesses and larger enterprises effectively.

Xero is well-suited for small to medium-sized businesses. Its scalable pricing plans and unlimited user feature make it a great choice for growing teams and remote collaboration.

It is ideal for businesses looking to go global, especially with its multi-currency support.

QuickBooks is highly recommended for small to mid-sized businesses and also works well for larger companies needing more advanced reporting and accounting tools.

Its payroll features, robust integrations, and strong mobile app make it a versatile option for a wide range of business sizes.

#9 Xero Pros & Cons

✔️ Pros

- Unlimited users → best for teams

- Affordable (80–90% cheaper than QuickBooks)

- Multi-currency on all plans

- Clean, beginner-friendly experience

- Great third-party integrations

❌ Cons

- Payroll not available everywhere

- Inventory features are basic

- Some advanced features require add-ons

#10 QuickBooks Pros & Cons

✔ Pros

- Best-in-class payroll

- Advanced reporting

- Strong US compliance

- Feature-rich mobile app

- Highly customizable

✘ Cons

- More expensive

- Multi-currency only in higher plans

- Limited users per plan

- Steep learning curve for beginners

🔥 Conclusion

Ultimately, the choice between Xero and QuickBooks comes down to your business’s specific needs.

If you’re looking for a simple, easy-to-use accounting tool that’s great for international businesses, Xero might be the right choice.

On the other hand, if you need advanced features, strong payroll integration, and a more established product, QuickBooks could be a better fit.

Take the time to evaluate what your business needs in terms of scalability, integrations, and support. Both platforms offer solid accounting features, but understanding your own unique needs is key to making the right decision.

For seamless supply chain management, consider exploring ShipChain solutions.

“RELATED ARTICLES”

Xero vs Sage: Which Accounting Software is Most Trusted?

FreshBooks vs Xero: Which Accounting Software WIN’s?

❓ FAQs

1. Which software is cheaper, Xero or QuickBooks?

Xero offers significantly lower pricing, with its plans starting at $2.90/month, while QuickBooks starts at $9.50/month.

2. Which platform offers better payroll features?

QuickBooks provides more robust payroll features, including direct deposit and tax calculations, while Xero offers payroll as an add-on service.

3. Which software supports multiple currencies?

Xero supports multiple currencies in all its plans, while QuickBooks only offers multi-currency support in its higher-tier plans.

4. Which software is better for large businesses?

QuickBooks offers an Advanced plan tailored to large businesses, while Xero does not have a specific plan designed for enterprises with complex needs.

5. Which is easier to use for beginners?

Xero is generally considered more user-friendly with its simple interface, while QuickBooks can have a steeper learning curve, especially for new users.

I’m a CRM and Xero expert with over 6 years of experience. I specialize in researching, testing, and simplifying complex systems like Xero and other CRM tools. From setting up workflows to writing easy-to-understand content, I help businesses choose the right platforms and use them better for real growth.