Still using Xero but feel like it’s not the right fit for your growing business?

You’re not alone. Many small business owners and teams feel limited by Xero’s pricing, complex interface, or lack of support for local needs like GST billing or logistics tracking.

Imagine using a tool that’s simpler, faster🚀, and made for your business type. Whether you manage deliveries, run a retail shop, or want better automation there are smarter options available today.

In this guide, you’ll discover the 🎖️ top 5 best Xero alternatives. We compare features, pricing, pros & cons, and explain why ShipChain is the #1 trusted pick for modern businesses today. 🚀

💡 Why People Switch from Xero in 2025

Xero is a popular accounting software. It’s stable, polished, and widely used.

But here’s the truth most businesses discover:

1️⃣ Xero becomes expensive as your needs grow

Want inventory? Want multi-currency? Want analytics?

You must upgrade your plan.

2️⃣ Payroll is limited by region

If you’re not in the US/UK/AU/NZ → payroll requires external tools.

3️⃣ Inventory & logistics tools are basic

No material tracking, no supply chain visibility, no warehouse tools.

4️⃣ The dashboard is not beginner-friendly

New users feel overwhelmed with too many menus and accounting jargon.

5️⃣ Xero does not fit growing operational businesses

If you handle stock, deliveries, multi-location business, or supply chain → Xero feels incomplete.

If you want a full breakdown of Xero’s updated subscription costs, read our detailed guide on the Xero Pricing 2025.

Problems with Xero

Xero is a great tool, but it doesn’t suit everyone. Here are its main drawbacks:

- Difficult for New Users – If you’re just starting, Xero can feel confusing with too many features on one screen.

- Payroll is Limited – Payroll is only available in select countries like Australia, the UK, and the US. If you’re in India or other regions, you need third-party software.

- Costly for Growing Teams – As you add more features (like multi-currency, time tracking, or inventory), the price increases quickly.

- Basic Project Management – Xero offers project tracking, but it lacks advanced tools like Gantt charts or team scheduling.

- Fewer Local Integrations – Especially in non-Western countries, it may not work with your local payment apps, tax systems, or invoicing formats.

🏆 5+ Best Xero Alternatives for 2025

If you’re looking for a tool that better fits your business needs or offers more flexibility than Xero, you’re in the right place.

Here, we break down the top 5 Xero alternatives that stand out in terms of features, pricing, and user satisfaction for 2025.

1️⃣. ShipChain: Best for Inventory, Logistics & Finance in One

ShipChain combines accounting and logistics in one platform. It not only helps you track money, but also lets you manage inventory, shipping, and order movements in real-time.

Unlike Xero, which only focuses on finances, ShipChain helps with product tracking, warehouse control, and delivery workflows making it a complete solution for businesses that move goods or handle stock regularly.

Top Features:

- Real-time shipment & inventory tracking

- Built-in invoicing and billing

- GST-ready reports for Indian businesses

- Dashboard for tracking sales, purchases & returns

Pricing:

- Starter: $99/month

- Professional: $299/month

- Enterprise: Custom

Pros

✔ Designed for real operations

✔ No complexity

✔ All-in-one workflows

✔ Customization available

Cons

✘ Not ideal for freelancers

✘ Mobile app still being improved

Pros:

Platform Support: Web | Android (Beta) | Email Support

Verdict: If your business deals with logistics or products, ShipChain is the smarter, more complete option than Xero.

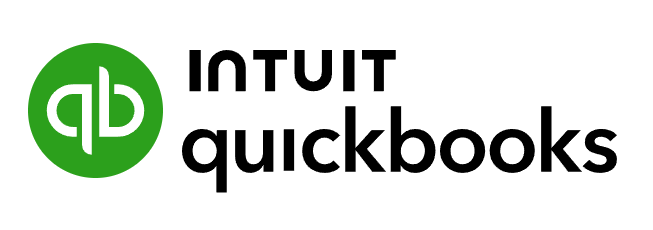

2️⃣. QuickBooks Online: Best for Tax-Focused and US-Based Businesses

QuickBooks is very strong in handling finances, taxes, and payroll especially for U.S.-based businesses. It helps you track every dollar that comes in and goes out.

You can create professional invoices, manage bills, run reports for tax filing, and handle employee payroll in one place. Its smart dashboard also helps you see your profit and loss clearly. Accountants love it because it connects easily with U.S. tax software.

Top Features:

- Strong expense tracking & bank integrations

- Payroll tools included

- US-based tax support

- Advanced reporting

Pricing:

- Simple Start: $5.70/month (was $19)

- Essentials: $8.40/month (was $28)

- Plus: $12/month (was $40)

- Advanced: $22.80/month (was $76)

Pros:

✔ Reliable and widely used

✔ Great support for U.S. tax forms

✔ Tons of accountant partners available

Cons:

✘ Expensive as you scale

✘ Complex for complete beginners

Platform Support: Web | iOS | Android | Phone & Chat

Verdict: Perfect for US businesses who want a tax-compliant and fully supported tool.

If you’re trying to decide between the two, make sure to check our full comparison — Xero vs QuickBooks? Don’t Choose Until You Read This!.

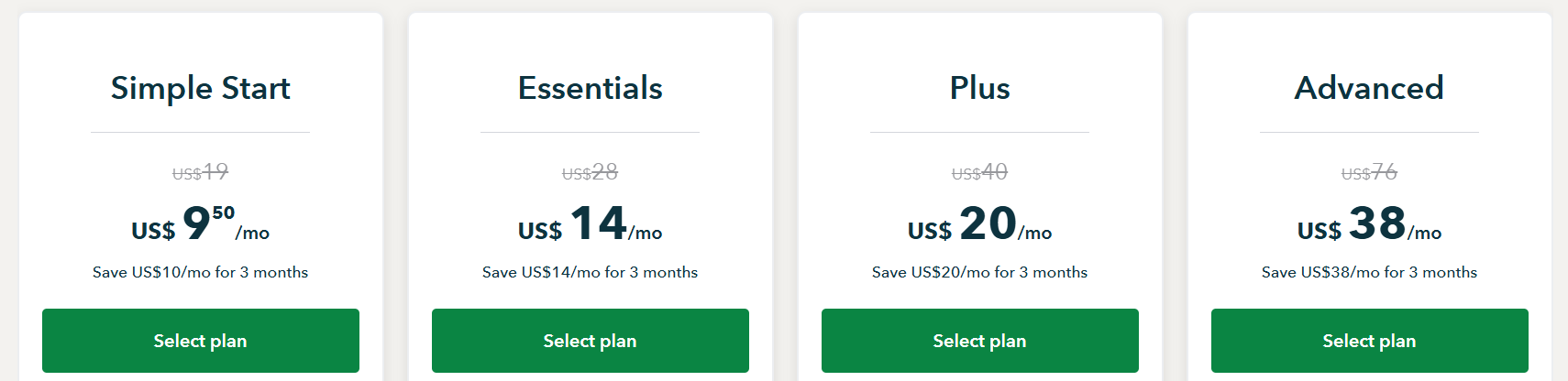

3️⃣. Zoho Books: Best for Businesses Using Automation & CRM

Zoho Books is part of the full Zoho ecosystem, which means it works smoothly with Zoho CRM, Email, Inventory, and more. It helps you automate daily tasks like sending invoices, collecting payments, tracking inventory, and managing taxes.

You can also create smart workflows like automatically reminding clients to pay or tagging an expense to a specific project. It’s perfect for small businesses looking to save time with automation.

Top Features:

- Client portal for payments and communication

- Smart workflows and automation

- Integration with 50+ Zoho tools

- GST and tax filing support for Indian users

Pricing:

- Free: For businesses with revenue under $50,000

- Standard: $15/month (was $20)

- Professional: $40/month (was $50)

- Premium: $60/month (was $70)

Pros:

- Free plan for small teams

- Ideal for startups

- Seamless automation and CRM support

Cons:

- Payroll only available in India

- Takes time to learn full suite

Platform Support: Web | Mobile Apps | Email & Chat

Verdict: Best if you want to automate tasks and use a full ecosystem like Zoho CRM, Email, and Invoicing.

- Even independent, such as Zoho Books evaluation, appreciate its automation, workflows, and ecosystem advantages making it a strong alternative to Xero.

4️⃣. ZarMoney: Best for Tailor-Made Workflows & Controls

ZarMoney gives you full control to build your own accounting workflows. It’s great for businesses that don’t want to use rigid, fixed systems. You can customize invoices, set role-based permissions for team members, and control how your inventory is tracked.

It even shows live updates on cash flow and orders, helping you make smart decisions on the go. It’s flexible enough to fit service-based or product-based businesses.

Top Features:

- Sales & purchase order tracking

- Custom invoice builder

- Real-time inventory & cash flow

- User role permissions

Pricing:

- Small Business: $20/month

- Enterprise: Starts from $350/month (custom features and 30+ users)

Pros:

- Flexible and customizable

- Easy for both product and service businesses

- Great pricing

Cons:

- Limited project tracking

- No mobile app (yet)

Platform Support: Web | Live Chat

Verdict: Ideal for businesses needing full control over their operations but without complex add-ons.

5️⃣. ProfitBooks Best for Small Indian Businesses

ProfitBooks is made especially for Indian small businesses. It supports GST billing, lets you create invoices in regional languages, and works with Indian banks. It keeps things simple, so even non-accountants can use it easily.

It’s great for traders, freelancers, shop owners, and small online sellers who want clean accounting with local compliance.

Top Features:

- GST-ready billing

- Supports Indian banks and payment gateways

- Custom invoice branding

Pricing:

- Free: Available for up to 50 transactions per year

- Pro: ₹5,999/year

- Premium: ₹9,999/year

Pros:

- Designed for US laws

- Invoices in regional languages

- Simple interface for beginners

Cons:

- No multi-currency

- Very limited third-party integrations

Platform Support: Web | WhatsApp Support | Email

Verdict: Great for Indian solopreneurs, small traders, and offline shops moving online.

For additional insights, you can also check ProfitBooks Integration, which highlights its simplicity and strong fit for Indian micro-businesses.

📊 Feature Comparison Table

Here’s a quick look at what each software offers:

| Feature | ShipChain | QuickBooks | Zoho Books | ZarMoney | ProfitBooks |

|---|---|---|---|---|---|

| Inventory | ⭐ Best | Good | Good | Good | Basic |

| Logistics | ⭐ Best | No | No | No | No |

| U.S. Tax | Medium | ⭐ Best | Low | Medium | Low |

| Automation | High | Medium | High | Medium | Low |

| Ease of Use | High | Medium | Medium | Medium | High |

| Pricing | Flexible | High | Low | Medium | Low |

| Ideal For | Stock‑Based Biz | U.S. Companies | Startups | Custom Workflows | Indian SMBs |

🧭 How to Choose the Best Xero Alternative

Choosing the right replacement for Xero becomes easy when you match your business needs with what each tool offers. Use this simple decision framework👇

1️⃣ Choose ShipChain if…

- You manage inventory, stock, orders, or deliveries

- You need accounting + logistics + warehouse tools together

- You want automation for purchase orders, sales, and stock levels

- You run a product-based or multi-location business

👉 Best match for retail, wholesale, FMCG, manufacturing, logistics.

2️⃣ Choose QuickBooks Online if…

- You’re a U.S.-based business

- You need powerful tax tools and payroll

- You want easy accountant collaboration

👉 Best for consultants, contractors, small businesses, accountants.

3️⃣ Choose Zoho Books if…

- You want automation + workflows

- You already use Zoho CRM, Zoho Inventory, Zoho Mail

- You need client portals or multi-department processes

👉 Best for startups, agencies, and growing digital teams.

4️⃣ Choose ZarMoney if…

- You need custom invoices, workflows, and reporting

- You want highly flexible business rules

👉 Best for mid-sized companies with custom processes.

5️⃣ Choose ProfitBooks if…

- You want simple GST compliance

- You are a small Indian business, trader, or shop owner

👉 Best for MSMEs and freelancers in India.

⭐ Final Tip

If your business deals with physical products, ShipChain is the only tool that replaces Xero + Inventory Software + Delivery Management in one platform making it the most complete upgrade in 2025.

Xero Weak Points That Matter in 2026

Xero is reliable, but several limitations affect growing businesses in 2025:

1. Pricing increases as you scale

Essential features like inventory, analytics, and multi-currency only come in higher plans, making Xero costly for expanding teams.

2. Basic inventory & no logistics tools

Xero can’t manage warehouses, stock movement, deliveries, or multi-location operations big drawback for product-based businesses.

3. Payroll not available in most countries

If you’re outside the US/UK/AU/NZ, you must use separate payroll tools.

4. Steep learning curve

The interface is cluttered for beginners, with too many accounting-heavy menus.

5. Limited local integrations

Weak support for GST, local banks, UPI apps, and region-specific workflows.

⭐ Quick Summary

Xero works well for basic accounting but becomes restrictive when your business needs inventory, automation, or region-specific support.

❓FAQs

🧠 Final Conclusion

Xero is powerful but not for everyone. Its learning curve, regional limits, and extra costs push many users to search for better fits.

If you’re in logistics, inventory-heavy, or need a mix of accounting + operations ShipChain is the clear winner.

It’s designed to handle what Xero can’t: bringing finance and supply chain into one clean, simple platform.

Want help setting it up? ShipChain offers onboarding support too.

1. Can I import my Xero data into these alternatives?

Yes, most platforms like ShipChain, QuickBooks, and Zoho Books allow you to import invoices, contacts, and financial history from Xero using CSV files or migration tools.

2. Are these alternatives cloud-based like Xero?

Yes, all 5 alternatives—ShipChain, QuickBooks, Zoho Books, ZarMoney, and ProfitBooks are cloud-based, so you can access them from anywhere.

3. Which tool is best for businesses outside the US?

ShipChain and ProfitBooks are great for businesses in India, while Zoho Books supports multiple regions with localized features like tax and language settings.

4. Can I try these alternatives for free before switching?

Yes. Tools like Zoho Books and ProfitBooks offer free plans or free trials. ShipChain offers a demo or custom onboarding based on your business needs.

I’m a CRM and Xero expert with over 6 years of experience. I specialize in researching, testing, and simplifying complex systems like Xero and other CRM tools. From setting up workflows to writing easy-to-understand content, I help businesses choose the right platforms and use them better for real growth.