Looking for the perfect accounting software for your business? 🤔

You’re in the right place and this comparison will give you the exact clarity you need. 🚀

Start your 30-day free trial today

Unlock 50% off 3 months of Pro†

This guide is designed to help you take action fast, choose confidently, and avoid wasting time on tools that don’t fit your business. 💡

By the end of this page, you’ll know whether Wave or Xero is the smarter choice for you in 2025 with zero confusion.

Let’s jump in and make your decision easy.

🔍 What Is Wave and Xero?

Wave:

Wave is a free accounting tool made for freelancers, solopreneurs, and tiny businesses.

It covers the basics invoicing, expense tracking, receipts, and simple reports without any monthly cost.

Perfect if you want straightforward bookkeeping without advanced features.

👉 If you want basic features for free, Wave is a solid choice.

👉 If you want detailed financial control and reports, Xero may be a better fit.

📊 2. Quick Feature Comparison Table

| Feature | Wave (Pro) | Xero (Starter) |

|---|---|---|

| Invoicing | Unlimited, customizable | Limited (20 invoices/month) |

| Expense Tracking | ✔ | ✔ |

| Bank Reconciliation | ✔ | ✔ |

| Financial Reports | Basic only | Advanced + custom |

| Inventory | ❌ | ✔ (higher plans) |

| Multi-Currency | ❌ | ✔ (Premium) |

| Payroll | Only US & Canada | Many regions |

| Integrations | Limited | 1,000+ apps |

🔍 Feature Comparison: Wave vs Xero

🧾 Invoicing

| Invoicing | Wave | Xero |

|---|---|---|

| Key Points |

Unlimited free invoices Recurring invoices included Custom templates Invoice tracking |

Limited in Starter (20 invoices / month) Recurring invoices only in higher plans More automation & reminders Better for growing teams |

| Winner | Best for free users | Best for advanced workflows |

💳 Payments

| Payments | Wave | Xero |

|---|---|---|

| Capabilities |

Accept credit card & bank payments Only standard processing fees (2.9% + $0.60) No monthly charges |

Uses Stripe / PayPal integrations Extra fees for add‑ons More automation for bulk payments |

| Winner | Tie overall, but Wave is cheaper for small users | |

💼 Payroll

| Payroll | Wave | Xero |

|---|---|---|

| Features |

Only available in US & Canada Basic payroll |

Full payroll workflows Works in more countries Auto‑tax calculations Employee self‑service |

| Winner | Limited basic option | Xero clearly ahead for payroll |

📚 Accounting

| Accounting & Reporting | Wave | Xero |

|---|---|---|

| Core System | Single‑entry bookkeeping | Double‑entry bookkeeping |

| Reports | Basic reports | P&L, balance sheet, cash flow Analytics & forecasting |

| Winner | Okay for simple books | Xero is clearly stronger |

🔧 Advanced Features

Here’s where the difference becomes clearer:

- No inventory tracking.

- No project tracking or time logging.

- No multi-currency transactions.

- Limited reporting options for advanced financial tracking.

- No automated workflows for recurring transactions or projects.

- Offers inventory tracking in Standard & Premium.

- Has project tracking and job costing tools.

- Allows multi-currency support in Premium.

- Advanced reporting tools for profitability and cash flow.

- Customizable workflows for automated invoicing and payments.

👉 If your business involves stock, multiple currencies, or billable projects Xero is a better option.

📌 To understand whether your business needs CRM or accounting software, you can read this short guide on the difference.

💸 Pricing Comparison

Here’s a quick look at how Wave and Xero charge for their services:

Wave Pricing

| Plan | Price | Billed | Features Summary |

|---|---|---|---|

| Starter | $0/month | Free Forever | Great for basic accounting — invoicing, tracking expenses. |

| Pro | $170/year | Annually | Adds bank connections, receipt scanning, chat support. |

Wave is one of the few tools that offers real accounting features completely free which is why many solo entrepreneurs love it.

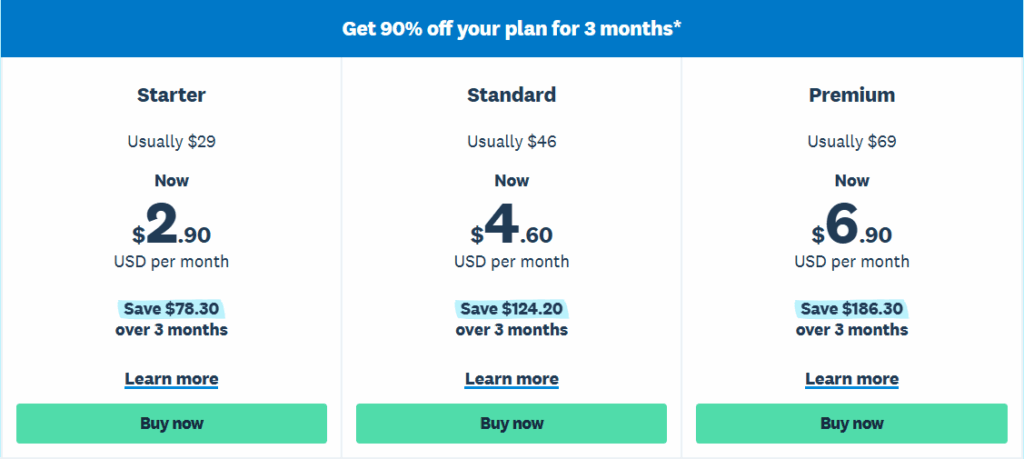

Xero Pricing

| Plan | Original Price | Now (90% Off for 3 Months) | Total Savings (3 Months) | Best For |

|---|---|---|---|---|

| Starter | $29/mo | $2.90/mo | Save $78.30 | Freelancers & basic accounting |

| Standard | $46/mo | $4.60/mo | Save $124.20 | Small businesses needing more features |

| Premium | $69/mo | $6.90/mo | Save $186.30 | Global businesses needing multi-currency |

Xero doesn’t offer a free plan, but it gives you access to business-level features especially helpful as your business grows or becomes more complex.

✅ Pros and Cons: Xero vs Wave

Xero

| ✅ PROS | ❌ CONS |

|---|---|

|

|

Wave

| ✅ PROS | ❌ CONS |

|---|---|

|

|

Which One is the Best Choice for Small Businesses?

Wave is the Clear Winner 🏆 in this (Wave Vs Xero) Comparison. While Xero offers more features, Wave stands out as the best value-for-money choice, especially for freelancers, startups, and small business owners who don’t want to spend hundreds of dollars each year on accounting software.

If you’re exploring CRM tools alongside accounting software, this quick guide shows how CRM systems help businesses grow.

🎯 Final Call: Who Should Choose Wave?

If you’re a freelancer, a small business owner, or just looking for a smart, budget-friendly way to manage your finances Wave is hands-down the better option.

It’s not just about saving money. It’s about getting exactly what you need, without the stress of paying for features that don’t matter to you.

🏁 Winner: Wave Accounting – Simple, effective, and affordable (or free!).

🧠 Which One Is Best for You?

After comparing pricing, features, ease of use, and scalability, the answer is clear:

⭐ Wave is the better choice for most small businesses, freelancers, and solopreneurs in 2025.

Wave wins because it delivers exactly what new or early-stage businesses need invoicing, expense tracking, and basic reports all for free.

You’re not paying monthly fees, not dealing with complex setups, and not buying features you’ll never use.

Xero is still a fantastic tool, but it’s built for growing teams, inventory-heavy companies, and businesses needing automation, payroll, or multi-currency support. It’s powerful but also more complex and more expensive.

- ✅ Choose Wave if you’re just getting started, managing a side hustle, or want a free, simple tool to track income and send invoices.

- ✅ Choose Xero if you run a growing business, want to manage inventory, connect multiple tools, or need full accounting reports.

“RELATED ARTICLE”

Xero vs Sage : Which Accounting Software is Most Trusted?

Xero vs QuickBooks? Don’t Choose Until You Read This!

🤔 FAQs

❓ 1. Is Wave really free to use?

Yes. Wave’s Starter plan is completely free and includes invoicing, expense tracking, and basic reports. You only pay payment-processing fees or if you upgrade to Wave Pro.

❓ 2. Which is better for small businesses: Xero or Wave?

Wave is better for freelancers and very small businesses on a budget. Xero is better for growing businesses that need inventory, automation, multi-currency, and advanced reporting.

❓ 3. Does Wave offer payroll like Xero?

Wave offers payroll only in the US & Canada as a paid add-on. Xero provides more complete payroll features across multiple regions and integrates deeply with HR tools.

❓ 4. Can I migrate from Wave to Xero later?

Yes. You can export Wave data (invoices, customers, reports) and import it into Xero manually or through migration tools. It’s easiest to switch at the end of a financial year.

❓ 5. Which software is easier for beginners?

Wave is simpler and more beginner-friendly. Xero has more features, so it takes a bit of learning but offers far better long-term scalability once your business grows.