Thinking about using Xero in 2026?

This review goes beyond features it reflects real hands-on testing, daily usage, and how Xero performs in real business workflows.

Start your 30-day free trial today

Whether you run an agency, an online store, or a service business, this guide will help you clearly understand if Xero fits your financial needs and long-term growth plans.

Let’s explore the tools that make Xero more than just accounting software it’s your all-in-one business powerhouse.

📌 What is Xero? How Its Stand Out in 2026?

Xero is a cloud-based accounting software that helps businesses manage their finances with ease. It is designed to automate various financial tasks such as invoicing, payroll, tax calculations, and more, making it ideal for small to medium-sized businesses.

Xero is accessible from anywhere, allowing users to manage their finances on the go. The platform also ensures that businesses comply with tax regulations and keeps their financial data up-to-date in real-time.

✔ “Learn more in our detailed Xero Pricing guide.”

My Experience Using Xero in Real Business Tasks (2025)

After using Xero for several weeks, I found that its biggest strength is how smoothly it fits into daily business tasks.

The dashboard loads quickly, financial data updates in real time, and most repetitive tasks like matching transactions or sending client invoices happen automatically with minimal input.

Xero’s bank feeds synced perfectly during testing, invoices matched to payments instantly, and the mobile app made expense uploads extremely convenient.

If you’re running a business where cash flow, billing, and compliance matter daily, Xero immediately reduces workload and increases accuracy.

📌 The Most Important Xero Features Explained

Managing daily finances becomes much easier when your accounting software handles most of the heavy lifting for you.

Xero is packed with features that reduce manual work, keep your books accurate, and help you stay on top of cash flow without stress. Here’s a simple breakdown of Xero’s most useful features and how they actually help in real business situations.

1. Online Invoicing for Faster Client Payments

One of Xero’s strongest capabilities is its online invoicing system built for small businesses that need billing automation, fast payments, and zero manual paperwork.

When I tested the feature, invoices took seconds to create, reminders were automated, and payments synced without any errors.

It helps reduce late payments, improves cash flow predictability, and removes the messy back-and-forth of manual billing.

🧠 How It Works:

- Create custom-branded invoices that reflect your business identity.

- Set recurring invoices for long-term clients and automate billing cycles.

- Enable payment reminders before or after the due date.

- Track when clients view or pay your invoices in real time.

- Integrate with Stripe, PayPal, or GoCardless to accept online payments instantly.

🚀 Why It’s Valuable:

Businesses using Xero’s invoicing tools report up to 50% faster payment collection. The automation reduces human effort and improves cash predictability, ensuring smoother monthly income.

💼 Best For:

Freelancers, consultants, and small businesses that rely on regular client billing and want to spend less time on manual follow-ups.

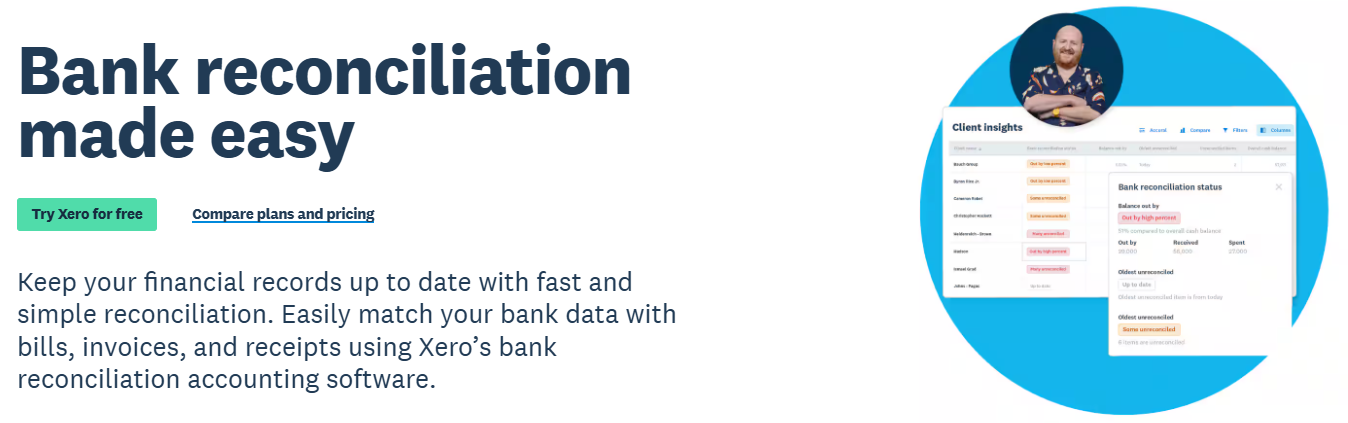

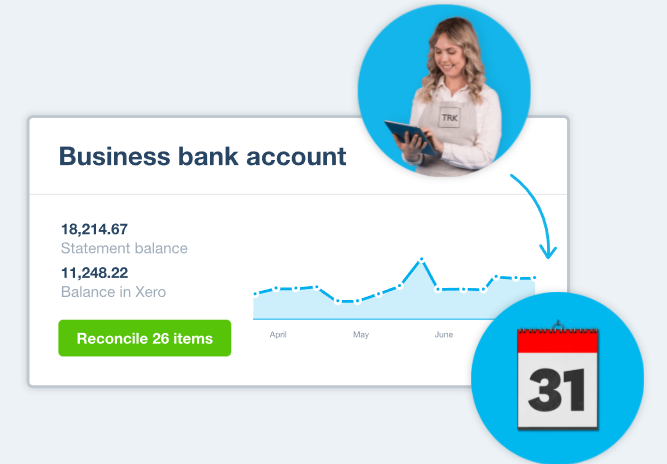

2. Bank Reconciliation Made Simple and Accurate

Bank reconciliation is often one of the most time-consuming accounting tasks.

Xero revolutionizes this process by automating the import, matching, and verification of your bank transactions.

Instead of juggling spreadsheets or manually marking payments, Xero syncs with your bank daily, keeping your books accurate and up to date.

This ensures that you always have a clear, real-time snapshot of your business finances.

🧠 How It Works:

- Connect your bank accounts or credit cards securely to Xero.

- The system automatically imports daily transactions.

- Xero’s smart matching algorithm aligns payments with invoices and bills.

- Create custom reconciliation rules for recurring expenses like rent or utilities.

- Review, approve, or adjust matches with just one click.

🚀 Why It’s Valuable:

Accurate reconciliation means zero discrepancies at month-end. You’ll always know your true cash position, helping you make data-driven business decisions and stay tax-compliant effortlessly.

💼 Best For:

Businesses that handle multiple accounts or high transaction volumes, such as e-commerce stores or agencies.

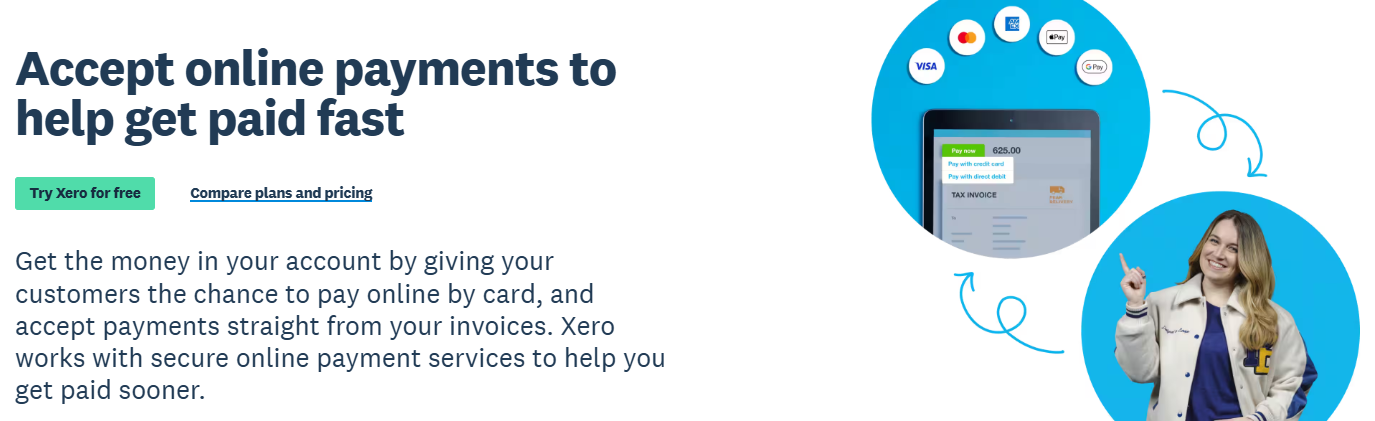

3. Accept Payments Easily and Boost Cash Flow

Delayed payments can cripple a business’s cash flow. Xero’s payment integration feature solves this by allowing customers to pay instantly through their preferred payment methods.

It transforms every invoice into a click-to-pay experience, ensuring that you receive funds faster and with fewer manual processes involved.

🧠 How It Works:

- Add a “Pay Now” button on your digital invoices.

- Accept payments through credit/debit cards, PayPal, or Stripe.

- Automatically reconcile payments once received.

- Offer multi-currency support for international clients.

- Generate automatic receipts to confirm successful payments.

🚀 Why It’s Valuable:

Businesses that use Xero’s payment feature see a significant reduction in overdue invoices. By eliminating friction in the payment process, you not only get paid faster but also deliver a seamless client experience.

💼 Best For:

Service-based companies, freelancers, and global sellers who want to streamline their payment process and improve cash flow predictability.

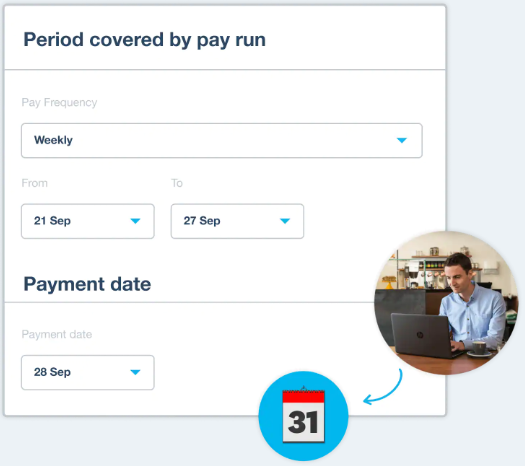

4. Payroll Management and Tax Compliance Tools

Handling payroll manually can lead to errors, missed deadlines, and compliance issues.

Xero simplifies this with a built-in payroll management system that automates everything from pay runs to tax deductions.

Whether you have two employees or fifty, Xero ensures everyone gets paid correctly and on time without the spreadsheets or confusion.

🧠 How It Works:

- Automate salary payments, tax deductions, and benefits.

- Set up custom pay schedules for full-time or part-time employees.

- Employees can access self-service portals for payslips and leave records.

- Integrate with time-tracking software for precise payments.

- Generate detailed payroll summaries and tax reports for compliance.

🚀 Why It’s Valuable:

Payroll automation not only reduces admin workload but also minimizes compliance risks. Xero ensures your business meets tax regulations automatically, saving hours every month and avoiding costly mistakes.

💼 Best For:

Small to medium businesses managing multiple employees who want to stay compliant and efficient without outsourcing payroll.

5. Expense Tracking for Smarter Business Spending

Tracking receipts and business expenses can be tedious especially when you’re on the go.

Xero’s expense management feature makes this effortless by digitizing the process.

It allows you and your team to upload recepts, categorize expenses, and approve claims instantly, ensuring you never lose track of where your money goes.

🧠 How It Works:

- Capture receipts using your phone and upload them through the Xero app.

- Xero’s AI technology automatically categorizes expenses by type.

- Set up multi-level approvals for expense claims.

- Reimburse employees directly through connected bank accounts.

- Track spending patterns and generate visual expense summaries.

🚀 Why It’s Valuable:

Expense management helps you control unnecessary costs and maximize tax deductions. By keeping every transaction digital and organized, Xero saves you time during audits and eliminates manual recordkeeping.

💼 Best For:

Businesses with traveling teams, remote workers, or multiple departments needing fast and transparent expense tracking.

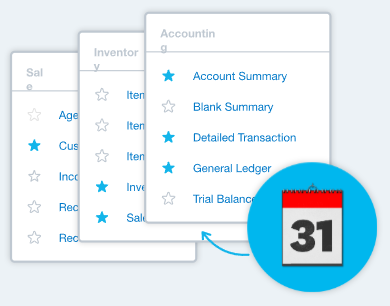

6. Reporting & Analytics for Financial Insights

Numbers alone don’t tell the story of your business insights do.

Xero’s reporting and analytics tools convert raw financial data into easy-to-read visual reports.

You can understand your profits, cash flow trends, and business performance in real time no accountant required.

🧠 How It Works:

- Generate reports like Profit & Loss, Cash Flow, and Balance Sheets with a few clicks.

- Apply filters and custom fields for deeper analysis by client, project, or date range.

- Use visual dashboards to spot trends or overdue payments.

- Automate report delivery to your email inbox.

- Integrate with advanced tools like Fathom or Spotlight Reporting for detailed analysis.

🚀 Why It’s Valuable:

With accurate, real-time reporting, you can make informed financial decisions that drive profitability. Xero gives you the same strategic advantage as large enterprises without needing a full finance team.

💼 Best For:

Entrepreneurs, financial managers, and startups who rely on performance tracking to drive growth and secure funding.

📌 Additional Xero Features You Should Know

These extra tools add more flexibility, automation, and control to your accounting workflow as your business grows.

7. Integrate Apps / App Marketplace

Xero’s App Marketplace is one of its strongest advantages. It allows you to connect Xero with over 1,000 third-party business tools, including CRMs like HubSpot, project management tools like Asana, payroll systems, and inventory software.

This ecosystem approach means you can build a customized financial stack that fits your business workflow perfectly.

The integrations automate data syncing between platforms for example, when a sale is made on Shopify, it automatically updates your Xero accounts and inventory.

This seamless connection saves hours of manual work and ensures all your systems stay accurate and in sync.

8. Purchase Orders

Xero makes purchase order management easy by helping you create, send, and track purchase orders directly from your dashboard.

You can generate professional-looking purchase orders, send them to suppliers, and later match them with bills or invoices to ensure accuracy.

This feature is especially useful for businesses that frequently buy materials or goods.

It prevents duplicate orders, tracks supplier commitments, and improves cash flow visibility ensuring that every purchase is approved, logged, and accounted for.

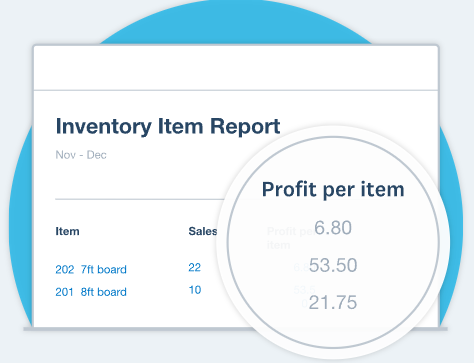

9. Inventory / Stock Management

For businesses selling physical goods, Xero’s inventory management feature helps track products, stock levels, and costs automatically.

You can monitor how much stock you have on hand, what’s selling best, and which items need reordering.

It also updates your inventory in real time whenever you create an invoice, purchase order, or sale, ensuring your records are always current.

This saves time for retailers, wholesalers, and e-commerce owners while improving accuracy in stock control and profitability analysis.

10. Quotes / Estimating

Xero’s Quotes and Estimating feature lets you create professional quotes and estimates quickly and send them directly to clients.

Once approved, you can convert them into invoices with a single click, maintaining a seamless workflow from inquiry to payment.

This tool is a game-changer for service-based businesses freelancers, agencies, or contractors as it helps standardize your pricing process, boosts professionalism, and speeds up deal closure. Plus, you can track the status of each quote to see who’s accepted or still pending.

11. Multi-Currency Accounting

If you deal with international clients or suppliers, Xero’s multi-currency accounting feature is invaluable. It supports over 160 currencies, updating exchange rates automatically every hour. This ensures that your reports, invoices, and reconciliations always reflect the latest rates.

You can send invoices, receive payments, and manage expenses in multiple currencies all while Xero calculates gains or losses automatically.

For global businesses, this eliminates the headache of manual conversions and ensures accuracy in every international transaction.

📌 Xero for Accountants & Bookkeepers

🧮 Xero for Accountants

Xero isn’t just built for small businesses it’s also designed to empower accounting professionals who manage multiple clients and want to streamline their practice.

With Xero for Accountants, firms can automate workflows, collaborate with clients in real time, and provide smarter advisory services without juggling spreadsheets or emails.

💼 1. Boost Efficiency and Accuracy

Accountants often waste valuable hours reconciling accounts or manually preparing reports.

Xero automates these repetitive tasks from bank reconciliation and compliance checks to tax report generation ensuring accuracy and freeing professionals to focus on higher-value strategic work.

Automation reduces data-entry errors and standardizes workflows, allowing firms to deliver more accurate financial insights, faster.

🤝 2. Strengthen Client Relationships

One of Xero’s greatest advantages is its shared-access model. Accountants and clients work on the same real-time data, eliminating version conflicts and delays.

This transparency builds trust, improves communication, and enables proactive advice not just reactive bookkeeping.

Clients can see updates instantly, while accountants can flag issues before they become problems.

📈 3. Scale Your Practice

As firms grow, managing dozens of clients becomes complex. Xero simplifies scaling with its integrated ecosystem of CRM, analytics, and reporting tools.

You can onboard new clients in minutes, automate recurring work, and track key metrics from a unified dashboard ensuring service quality never drops as your firm expands.

⚙️ Xero Workpapers

Xero Workpapers is a specialized tool built for accountants and bookkeepers to simplify compliance, year-end preparation, and review processes.

It lets professionals create and manage digital workpapers, standardize documentation, and automatically pull data from Xero ledgers reducing manual data entry and review time.

You can use it to manage client checklists, record adjustments, and attach supporting documents all in one place.

Think of Workpapers as your digital audit file, keeping every record organized, accurate, and ready for submission.

🧭 Xero HQ

Xero HQ serves as the central control hub for accounting and bookkeeping firms.

It provides a bird’s-eye view of client activity, deadlines, and tasks helping professionals prioritize and manage workloads efficiently.

With built-in client insights and notifications, you’ll always know which clients need immediate attention (e.g., overdue reconciliations or pending returns).

Xero HQ also integrates with CRMs and workflow tools, allowing firms to operate like well-orchestrated systems consistent, transparent, and client-focused.

📚 Xero for Bookkeepers

While accountants focus on financial strategy, Xero for Bookkeepers empowers professionals who handle daily financial tasks and client recordkeeping.

It’s designed to simplify data entry, ensure accuracy, and improve collaboration allowing bookkeepers to handle more clients efficiently.

⏱️ 1. Save Time with Automation

Bookkeepers can automate routine processes like invoicing, bank reconciliation, payroll, and expense categorization.

Instead of spending hours reconciling transactions, Xero performs these actions automatically, freeing up time to focus on client support, reporting, or business development.

🧾 2. Real-Time Collaboration

With shared cloud access, bookkeepers and clients always see the same live financial data.

This means no duplicate spreadsheets or outdated reports decisions can be made instantly with accurate, up-to-the-minute numbers.

It also cuts down on back-and-forth communication, saving time and minimizing errors.

🚀 3. Grow and Manage Your Bookkeeping Business

Using Xero’s suite of integrations and reporting tools, bookkeepers can manage their workload, track profitability, and even collaborate with accountants within the same ecosystem.

It’s ideal for those scaling up offering the structure to handle more clients while maintaining precise, consistent service.

💼 Xero for Business

Beyond accounting professionals, Xero is equally powerful for small and medium-sized businesses (SMEs) looking to manage their own finances.

The Xero for Business suite helps business owners control everything from invoicing and expenses to payroll and reporting all within a single, easy-to-use cloud platform.

By connecting bank accounts, automating bookkeeping, and enabling real-time collaboration with accountants, Xero gives business owners complete financial visibility.

Whether it’s tracking cash flow, monitoring expenses, or preparing tax filings, Xero simplifies finance management and ensures compliance without needing deep accounting expertise.

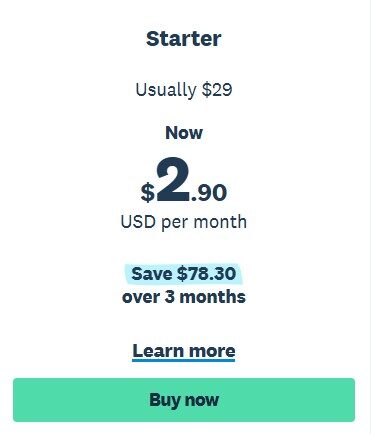

📌 Xero Pricing Plans

Xero offers three primary plans:

1. Starter Plan

- Original Price: $29/month

- Discounted Price: $2.90/month (Save $78.30 over 3 months)

Features:

- Send quotes and up to 20 invoices.

- Enter up to 5 bills.

- Reconcile bank transactions.

- Capture bills and receipts with Hubdoc.

- Short-term cash flow and business snapshot.

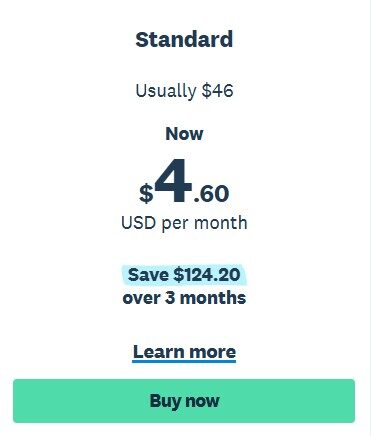

2. Standard Plan (Most Popular)

- Original Price: $46/month

- Discounted Price: $4.60/month (Save $124.20 over 3 months)

Features:

- Send quotes and invoices.

- Enter bills (with no limits).

- Reconcile bank transactions.

- Capture bills and receipts with Hubdoc.

- Short-term cash flow and business snapshot.

- Bulk reconcile transactions.

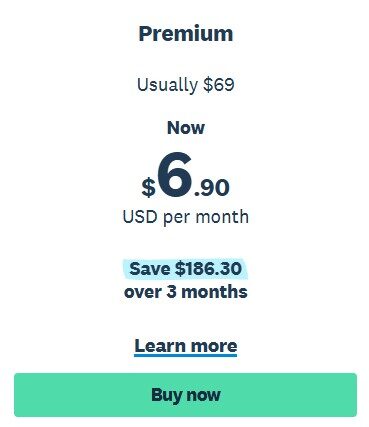

3. Premium Plan

- Original Price: $69/month

- Discounted Price: $6.90/month (Save $186.30 over 3 months)

Features:

- Send quotes and invoices.

- Enter bills (with no limits).

- Reconcile bank transactions.

- Capture bills and receipts with Hubdoc.

- Short-term cash flow and business snapshot.

- Bulk reconcile transactions.

✔ “Looking for discounts? Here’s our updated Xero Coupon Code page.”

📌 Pros and Cons for Xero

| Point | Pros of Xero | Cons of Xero |

|---|---|---|

| User‑Friendly Interface | Easy to navigate, even for non‑accountants. | Advanced options can still feel complex at start. |

| Automation | Automates invoicing, bank reconciliation, and payroll. | Requires proper setup; mistakes can repeat automatically. |

| Cloud‑Based | Access from anywhere, anytime, on any device. | Depends completely on internet connection and uptime. |

| Multi‑Currency Support | Helpful for international clients and global payments. | Exchange‑rate handling can be confusing for new users. |

| Reporting | Customizable reports for better financial insights. | Building custom reports can take time to learn. |

| Pricing | Different plans for different business sizes. | Can be expensive for very small businesses or freelancers. |

| Payroll & Support | Integrated payroll in supported regions. | Limited payroll in some areas and no phone support. |

Real users on G2 also rate Xero highly for ease of use, automation, and overall reliability.

📌 Where Xero Still Needs Improvement

Although Xero is powerful, it’s not perfect. A few areas can feel limiting depending on your business type:

- Payroll features vary by region and may require add-ons

- Starter plan limits (like invoice caps) force upgrades early

- No phone support for urgent situations

- Some advanced reports feel basic compared to QuickBooks

- Multi-location inventory requires additional apps

These limitations don’t affect every business, but they’re important to consider before switching.

📌 Xero Security: Is It Safe to Use?

Xero prioritizes the security of your business data with several robust protection measures:

1. Two-Factor Authentication (2FA):

Xero requires two forms of identification to access your account, adding an extra layer of security. Even if someone gains access to your password, they cannot log in without the second authentication, typically a code sent to your phone.

2. Bank-Grade Encryption:

Xero uses bank-level encryption to protect your data, both in transit and at rest. This ensures your financial information is kept secure and confidential, similar to the security used by financial institutions.

3. Regular Security Updates:

Xero regularly releases security updates to address vulnerabilities and stay ahead of emerging threats, ensuring your accounting system remains protected.

With these features, Xero provides a secure environment to manage your business financials with confidence.

📌 Xero vs. Competitors: How Does It Compare?

Xero stands out from its competitors, such as QuickBooks, FreshBooks, and Sage, in several key areas:

1. Customization & Flexibility

Xero offers deeper customization than most competitors. Reports, invoices, workflows, and integrations can all be tailored to match your business needs.

QuickBooks also offers strong customization, but Xero’s ecosystem of 800+ apps and cleaner UI makes it easier to build a fully automated financial system without extra complexity.

2. Cloud-Based Collaboration

Unlike older accounting systems like Sage, Xero is 100% cloud-native. This means no installations, no backups, and no version conflicts. Multiple team members, accountants, and bookkeepers work from the same real-time data something FreshBooks and Wave don’t offer at the same depth.

3. Multi-Currency Support

Xero’s multi-currency accounting is one of the best available. It supports 160+ currencies, auto-updates exchange rates every hour, and tracks gains/losses automatically.

FreshBooks and Sage charge extra for multi-currency; Wave does not offer advanced currency features.

4. Automation Power

Xero’s automation (invoicing, reconciliation, payments, expenses) is noticeably smoother and faster than many competitors.

QuickBooks has strong automation too, but Xero’s interface feels simpler and more intuitive, especially for users who dislike technical accounting tools.

5. Pricing

Xero isn’t the cheapest especially for freelancers.

But compared to QuickBooks (which becomes expensive after add-ons), Xero offers more value at mid-level and premium plans.

✔ “We have a full comparison of Xero vs QuickBooks with real test results.”

📌 📊 Xero Alternatives Comparison 2026

| Software | Best For | Starting Price | Key Strength | Weakness |

|---|---|---|---|---|

| QuickBooks Online | Advanced accounting & detailed reporting | $30/mo | Strong reporting, deep automation | More expensive with add‑ons |

| FreshBooks | Freelancers & service‑based work | $17/mo | Easiest invoicing & client billing | Weak inventory & multi‑currency |

| Wave Accounting | Very small businesses, beginners | Free | Free invoicing & bookkeeping | Limited automation, no inventory |

| Sage Accounting | Compliance‑heavy traditional businesses | $10/mo | Strong ledger, reliable compliance | Old‑school interface, less beginner‑friendly |

| Zoho Books | Affordable CRM‑friendly solution | $15/mo | Best value + integrates with Zoho CRM | Limited third‑party integrations |

| Xero (Reference) | Growing SMEs, eCommerce, global business | $15/mo | Multi‑currency, automation, 800+ apps | No phone support, starter limits |

📌 Is Xero Worth It for Small Businesses in 2026?

Xero is a powerful accounting tool, but is it worth the investment for small businesses in 2024? The answer depends on your business size, financial needs, and growth plans. Here are some key factors to consider:

1. Integration Capabilities

Xero integrates with over 800 third-party apps, allowing you to connect your e-commerce platform, CRM, payroll system, and more. This capability makes it easier to streamline your business operations into a single cohesive workflow, offering flexibility and customization tailored to your business needs.

2. Time-Saving Features

Xero’s automation features such as automatic bank reconciliation, recurring invoices, and expense categorization—can save you significant time. If you’re a small business owner overwhelmed by administrative tasks, Xero’s automation lets you focus more on growing your business rather than managing finances. These time-saving features alone can justify the investment.

3. Real-Time Reporting

Xero provides real-time reporting, offering instant access to financial statements like Profit & Loss, Cash Flow, and Balance Sheets. This transparency allows small businesses to make informed decisions and keep track of their financial health without waiting until the end of the month. It’s a valuable tool for maintaining control over your business finances at all times.

📌 Who Should Use Xero (and Who Should Avoid It) in 2026?

Xero is a powerful accounting platform but it’s not ideal for every type of business. Choosing it depends on your size, workflow needs, and how much automation you expect. Here’s a clear breakdown to help you decide.

🔵 Xero Is Best For (Ideal Users)

Xero works incredibly well for businesses that want automation, cloud access, and streamlined workflows. It’s especially valuable if you manage recurring invoices, multi-currency payments, or high transaction volumes.

✅ Best suited for:

- Small & Medium-Sized Businesses

Need invoicing, payroll, bank reconciliation, and financial tracking in one place. - E-commerce Stores & Online Sellers

Integrates smoothly with Shopify, WooCommerce, Amazon, and inventory tools. - Agencies & Service-Based Companies

Perfect for recurring billing, project tracking, and client invoicing. - Businesses Operating Internationally

Multi-currency support with automatic exchange rates makes global payments simple. - Remote or Hybrid Teams

Cloud access lets teams, accountants, and bookkeepers collaborate in real time. - Growing Companies That Want Automation

Great for businesses wanting fewer manual tasks and more predictable cash flow.

🔵 Xero Might Not Be Right For (Who Should Avoid It)

While Xero is feature-rich, some users may find its pricing or features more than they need. For certain business types, a simpler or cheaper tool may be a better fit.

❌ Not recommended for:

- Freelancers or Very Small Businesses

If you only send a few invoices monthly, Xero’s cost may not justify its features. - Businesses With Complex Payroll Requirements

Some regions lack full payroll coverage; dedicated payroll tools may be better. - Users Who Prefer Phone-Based Customer Support

Xero mainly offers email and live chat — not ideal for people who want instant calls. - Businesses Needing Full Inventory or Manufacturing Management

Advanced inventory requires third-party apps, which adds extra cost. - Firms Wanting Deep, Fully Customized Reporting

Xero’s reporting is strong, but not as advanced as higher-end ERP systems.

✅ Final Verdict: Is Xero the Right Choice for You in 2026?

After using Xero day-to-day, I genuinely feel it’s one of the easiest and most reliable accounting tools for small and growing businesses. What stood out the most is how much time it saves.

Tasks that normally take hours like matching transactions, sending invoices, or checking cash flow happen automatically with almost no effort from your side.

Xero also gives you a clear picture of your finances at all times. Whether it’s overdue invoices, upcoming bills, or profit trends, everything updates in real time.

This makes running a business less stressful because you never feel “in the dark” about your numbers.

Of course, Xero isn’t perfect. The Starter plan comes with limits, some advanced features need upgrades, and customer support is chat/email only. But honestly, none of these were deal-breakers during my time using it. As your business grows, Xero grows with you and that’s something many tools don’t offer.

⭐ My Honest Take

If you want accounting software that’s simple, modern, and does most of the work for you, Xero is absolutely worth choosing in 2026. It makes bookkeeping easier, boosts productivity, and helps you stay on top of your finances without getting overwhelmed.

For growing businesses, agencies, online stores, and anyone dealing with multiple clients or currencies, Xero feels like a long-term partner not just another tool.

✔ “If you want to try it yourself, start with Xero’s 30-day free trial here’s our full Xero Free Trial guide.”

❓ FAQs

1. Is Xero easy to use for beginners?

Yes, Xero is clean, simple, and very beginner-friendly.

2. Does Xero support VAT and GST calculations?

Yes, Xero automatically handles GST, VAT, and local tax rules.

3. Can Xero integrate with my ecommerce store?

Yes, it connects with Shopify, WooCommerce, Amazon, and 800+ apps.

4. Does Xero support multi-currency accounting?

Yes, Xero supports 160+ currencies with live exchange rates.

5. Is my financial data safe in Xero?

Yes, Xero uses encryption, 2FA, and regular security updates to protect your data.